Navigating Real Estate in Mexico 2025: Costs, Laws & Tips

Your guide to buying property in Mexico: key steps, closing costs and FAQs

Updated 1/3/25 - Note: closing costs updated

Purchasing property in Mexico can be a rewarding venture, but navigating the legal and financial landscape requires careful preparation. From understanding the fideicomiso process to budgeting for closing costs, this guide provides all the essential information you need to invest with confidence.

Nothing beats expert advice and guidance when trying to navigate an overseas purchase. Reach out to the buyer's representatives at Mycasa Real Estate for knowledgeable guidance. We have an expert team in place, including bi-lingual attorneys, for help every step of the way.

Click to reach out to Mycasa Real Estate via Whatsapp or email us for more information at info@mycasa.mx

Read up using Mycasa's Relocation Guide for other tips and tricks and things to watch out for and take a moment to review the Expat Video Guide as well.

Table of Contents

- Understanding Foreign Ownership Laws in Mexico

- Key Steps to Purchasing Property in Mexico

- Financing Options for Mexican Real Estate

- Options for Land in the Riviera Maya

- Understanding Real Estate Closing Costs

- Taxes and Fees

- Risks and Post-Purchase Responsibilities

- Other Articles About Relocating to Mexico

- What are Clients Saying About Mycasa Real Estate?

- FAQs About Buying Property in Mexico

Understanding Foreign Ownership Laws in Mexico

Foreigners can legally own property in Mexico, but there are restrictions for properties located within 50 kilometers of the coast or 100 kilometers of an international border. In these "restricted zones," ownership must be facilitated through a fideicomiso—a bank trust that grants foreigners all the rights of ownership. For properties outside these zones, foreigners can purchase directly in their name.

Introduction

Living in Mexico as an expat can be a rewarding experience, offering a rich tapestry of cultural activities, affordable cuisine, and the opportunity to learn Spanish. Whether you are drawn to the bustling life of Mexico City or the tranquil beaches of the Riviera Maya, Mexico’s diverse landscapes and vibrant communities provide a fulfilling environment for those looking to make the country their home.

Can Foreigners Purchase Land in Mexico?

Foreigners can legally own property in Mexico, but there are restrictions for properties located within 50 kilometers of the coast or 100 kilometers of an international border. In these "restricted zones," ownership must be facilitated through a fideicomiso—a bank trust that grants foreigners all the rights of ownership. For properties outside these zones, foreigners can purchase directly in their name. There is information floating around the internet that foreigners can only lease property, such as in Bali, and that the Mexican government can come in and take your property at any time. This information is simply not accurate.

Key Points:

- A fideicomiso is a renewable 50-year trust, ensuring compliance with Mexican property laws.

- Trusts are handled by Mexican banks, with fees typically ranging from $500 to $1,000 annually.

Understanding the Restricted Zone

The restricted zone in Mexico encompasses areas within 100 kilometers of the international borders and 50 kilometers from the coast. Foreigners can acquire property in these zones through a fideicomiso (bank trust) or by establishing a Mexican corporation. The fideicomiso lasts for 50 years and can be renewed, with initial setup costs ranging from $500 to $1,000 USD.

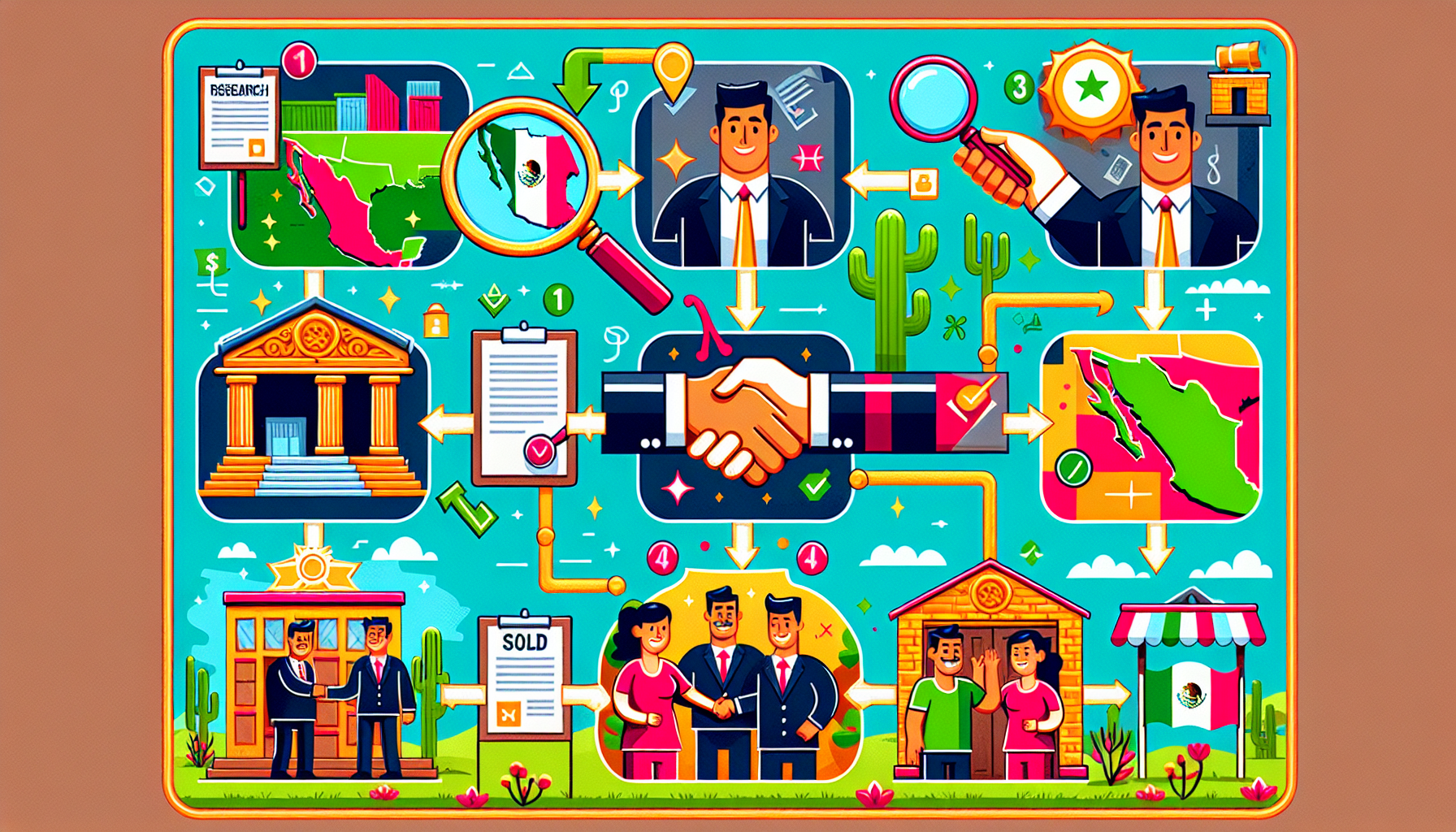

Key Steps to Purchasing Property in Mexico

Purchasing real estate in Mexico involves several key steps, starting with finding the right property and agreeing on a price with the seller.

- Define Your Goals and Budget: Identify the type of property—vacation home, investment property, or retirement retreat—and determine your financial capacity.

- Hire Professionals: Work with reputable real estate agents, attorneys, and notaries familiar with Mexican law.Engaging a knowledgeable Mexican attorney to review the purchase agreements and provide legal and tax advice is highly recommended.

- Conduct Due Diligence: Verify the property’s legal status, including title ownership and any existing liens. The due diligence process, for presale/preconstruction process, happens between the time you put down a reservation to block off the unit and the scheduled date of the first large deposit. For resales between private parties, all funds go into escrow until closing.

- Secure a Purchase Agreement: The seller’s agent will draft a sales agreement outlining the terms and timeline.

- Complete the Sale: Pay deposits, finalize financing (if applicable), and proceed to closing with the help of a notary.

Additionally, further surveys and checks might be necessary, including cadastral surveys and valuations for tax purposes. For pre-construction properties, understanding the sales contract and ensuring all necessary permits and approvals are in place is crucial.

Financing Options for Mexican Real Estate

1. Mortgages from Cross-border Banks

Lenders provide mortgages to foreign buyers, typically requiring:

- A 30%-50% down payment

- Loan terms of 5 - 30 years

- Fixed or variable interest rates between 9-13%

2. Seller Financing

For pre-construction or resale properties, private financing with the seller offers:

- Flexible terms

- Fewer qualification requirements

- Faster arrangements

Ensure the terms are clearly outlined in the sales contract, and funds are held in an escrow account until closing.

3. Developer Financing.

A small number of developers provide direct financing for up to 50% of the purchase price; to be paid back over 5 - 10 yrs. Rates generally start around 8-10%

4. Personal Lending

Many clients own other real estate back in their home countries. Access to the equity in those properties is typically much faster and less expensive than any other options when the full cash amount is not already at hand. You can close on a Home Equity Line of Credit (HELOC) within 30-45 days at a fraction of the closing costs compared to a regular mortgage; with the added advantage that the line can be re-used once paid off

Options for Land in the Riviera Maya

If youre looking for a solid invesment with great potential for upside and the possiblity of building your dream home in one of the most in-demand regions in all of Mexico, the Riviera Maya has what you're looking for. Explore these land options listed below.

| LOCATION |

MYCASA LISTING LINK |

STARTING PRICE (USD) |

| Playa del Carmen |

Link | $26,250 |

| Tulum |

Link | $26,000 |

| Puerto Morelos |

Link |

$63,000 |

| Akumal |

Link | $85,000 |

Ejido Land

Many foreigners come to Mexico and find incredible land deals that seem too good to be true. Typically these deals involve land which is classified as "ejidal" or communal agricultural lands.

If you're considering buying land that was previously classified as ejido land, it's essential to understand the unique challenges and risks involved. But don't worry – we're here to guide you through the process and explain why hiring a lawyer is your best move.

What is Ejido Land?

First, let's clear up what ejido land is. In Mexico, ejido lands were communal agricultural lands given to local communities for farming and livelihood. While these lands have now been allowed to be sold and bought privately, the transition from communal to private ownership involves a legal process called "regularization." This process ensures that the land is legally recognized as private property.

The Risks Involved

Incomplete Regularization If the regularization process isn't fully completed, the land might still have communal claims. This can lead to disputes and legal battles down the road. Title Issues Proper documentation is crucial. Without a clear title, proving ownership can become problematic, affecting your ability to sell, develop, or even use the land as you wish. Historical Claims Sometimes, former ejido members or their descendants might challenge the sale, claiming rights to the land based on historical use.

Why You Need a Lawyer

Navigating the legal intricacies of purchasing former ejido land can be daunting. Here's how a qualified real estate lawyer can make a difference:

Expert Document Review

Lawyers will meticulously examine all documents to ensure the regularization process is complete and the title is clear.

Legal Assurance

They can verify that there are no lingering claims or disputes over the property. Peace of Mind With a lawyer by your side, you can proceed with confidence, knowing that your investment is secure. Buying former ejido land can be a fantastic opportunity, but it's not without its challenges. By hiring an experienced real estate attorney, you can navigate these potential pitfalls with ease and ensure that your investment is protected.

Javier Contreras Nieto

CEO | Chief Attorney

Lighthouse Real Estate & Legal Services

Understanding Real Estate Closing Costs

Closing costs for purchasing property in Mexico can vary from 8% to 12% of the purchase price. The buyer is responsible for all closing costs, which can also include legal fees, notary fees, and other related expenses.

It’s important to budget for these costs and understand their implications on the overall transaction. Here's an example of closing costs for a land purchase of 115,500 USD

| Notary Public | Currency: USD |

| Public Registry Notice |

169.49 |

| No Liens Certificate |

29.80 |

| Acquisition Tax (4%) * updated, from 3% |

4620.00 |

| Ownership Update |

24.40 |

| Issuing Cost |

43.24 |

| Recording Fee |

338.05 |

| Registered Copies |

129.75 |

| Appraisal |

346.50 |

| Protocol Costs |

68.70 |

| Copies and Expenses Public Registry |

155.14 |

| Total Taxes and Expenses |

5925.07 |

| Notary Public Fee |

2687.46 |

| Value-Added Tax (VAT) 16% |

429.99 |

| Total Notary Fee |

3117.45 |

| Trustee Bank (Fideicomiso) |

|

| Bank Fee for Title Execution |

400.00 |

| First Year Trust Fee |

450.00 |

| VAT 16% |

136.00 |

| Permit from Ministry of Foreign Affairs |

1164.00 |

| Total Trustee Bank Fee |

2150.00 |

| Legal Services |

Currency (USD) |

| Attorney Fee |

2155.00 |

| VAT 16% |

344.83 |

| Total Estimated Closing Costs |

13,692.35 |

Taxes and Fees

- Property Acquisition Tax: ~2%-3% of the purchase price.

- Annual Property Taxes (Impuestos Prediales): Typically just a few hundred dollars.

- Paying early in the year can result in discounts.

- Maintenance Fees: Applicable for gated communities or condos.

Risks and Post-Purchase Responsibilities

Potential Risks

- Title disputes: Ensure the title is free from liens or disputes through due diligence.

- Scams: Watch for fake listings and fraudulent investment promises. Work with a reputable buyer's rep.

Post-Purchase Responsibilities

- Regular maintenance and security are essential for property preservation.

- For absentee owners, hiring a property management service can simplify maintenance and provide peace of mind.

Other Articles About Relocating to Mexico

Is it Safe for Americans to Buy Real Estate in Mexico

Why U.S. Expats Choose Mexico: Real Estate Insights 2024

Retire in Paradise: Top 10 Best Places for Expats 2024

Relocation Guide 2024 (part 9): 10 Warning Signs

Relocation Guide 2024 (part 8): How much Does it Cost to Build

What Are Clients Saying About Mycasa Real Estate?

"We have been beyond pleased...we felt in good hands the entire process." Jodi Ribar. Google Review

"...and within 5 minutes, she called me." Leanne Knox. Google Review

"He is incredibly knowledgeable about the area, knows all the details about the property..." Claudia Ruiz. Google Review

"She listened to every single detail of what I was looking for in a property..." Kendra Mangana-Adams. Google Review

Ready to book a trip and shop for your dream home, plan your trip with Google Travel

Frequently Asked Questions

Can Americans legally own property in Mexico?

Americans can legally own property in Mexico, but they must utilize a fideicomiso trust for properties located in restricted zones. This ensures compliance with Mexican property laws.

What is a fideicomiso?

A fideicomiso is a bank trust that enables foreigners to hold property in restricted zones in Mexico, granting them rights akin to those of a Mexican citizen. This legal structure ensures security and compliance with local regulations regarding property ownership.

What are the typical closing costs for buying property in Mexico?

Closing costs for buying property in Mexico generally range from 4% to 6% of the purchase price, and it is the buyer's responsibility to cover these expenses.

Are property taxes high in Mexico?

Property taxes in Mexico are generally lower than those in the U.S., typically amounting to only a few hundred dollars each year. This makes owning property in Mexico more affordable in terms of taxation.

What are the financing options for purchasing property in Mexico?

Financing options for purchasing property in Mexico primarily include mortgages from Mexican banks and private financing arrangements through developers or sellers. It is crucial to explore these options to determine the best fit for your financial situation.

Updated 01/03/25

Comments (0)