Unlocking Potential: Mexico Real Estate Market Forecast 2024

Top Reasons for Buying Real Estate in Mexico Right Now: 2024 Insight and Tips

Are you considering buying real estate in Mexico? This guide is here to help. We’ll cover everything you need to know—from understanding the favorable exchange rates and local economic growth to navigating legal requirements and finding the best investment opportunities.

Contact Mycasa Real Estate for expert advice and to find the latest hot deals. Take advantage of the favorable exchange rate.

Key Takeaways

-

The favorable current exchange rate allows U.S. dollar holders to invest in Mexican real estate at reduced costs, increasing potential savings.

-

Mexico’s economic stability and growth, driven by rising demand for housing and foreign investment, make it an attractive destination for real estate investment.

-

High rental yields ranging from 6.3% to over 10% in tourist areas present lucrative opportunities for investors in both vacation and long-term rentals.

Update - Sept 2024 - A preferential exchange rate, USD to MXN peso, means you pay less than you did a month ago

The current Mexican peso exchange rate is incredibly favorable for those holding US dollars.

A property that cost 4.2 million pesos last month required $227,000 USD at an exchange rate of 18.5.

Today, that same property costs just $210,000 USD due to a drop in the MXN rate.

This significant reduction means you could furnish the entire unit and even purchase a couple of bicycles with the savings.

The exchange rate may fluctuate slightly—from $19.98 to $20.00 within the next 24 hours, and a decrease to $19.86 tomorrow—but savvy investors can still capitalize on these changes. The current USD to MXN forecast indicates that the Mexican peso forecast suggests investing now could yield considerable financial benefits.

Take advantage of this moment to maximize your dollar in Mexico’s growing real estate market.

Economic Stability and Growth

Economic stability is the backbone of any sound investment, and Mexico offers a conducive environment for real estate investments. With sustained economic growth, increased housing demand, and potential property value appreciation, Mexico’s economy is on a positive trajectory.

Several factors contribute to this stability and growth.

Mexico's economy on the rise

Mexico’s growing economy is a key driver behind the rising demand for housing and the appreciating property values. For instance, Playa del Carmen has transformed from a quaint fishing village into a trendy urban locale, attracting international interest and boosting property values. Similarly, Mexico City, the nation’s capital, is not only a cultural and economic powerhouse but also a hotbed for real estate investment. The city’s upscale neighborhoods and ongoing urban development efforts make it a prime location for investors.

Moderate economic growth in Mexico has steadily increased property values. In Playa del Carmen, for instance, the influx of tourists and expatriates has driven these increases.

Analyzing investment cases shows that properties in high-demand areas yield better returns over time, making Mexico an attractive market for real estate investors.

Business confidence and foreign investment

Mexico’s positive business outlook creates a conducive environment for investment, boosting the real estate market. Foreign investors are particularly drawn to properties near beaches or major cities, where returns can reach up to 15%. The upcoming Mayan Train project in Playa del Carmen is expected to significantly increase tourism, further enhancing real estate investment opportunities.

Mexico City’s diverse real estate market offers numerous investment opportunities, benefiting from significant urban development and a large population base. The growing confidence in Mexico’s economy and the influx of foreign investment are key factors driving the real estate market’s growth. High-demand areas can yield substantial returns, making them an attractive option for investors.

Foreign Direct Investment in Mexico increased from 28B to 25B USD from 2020 to 2022

Impact of inflation on real estate

Inflation significantly influences property investment decisions, making it important for investors to understand its impact. The consumer price index (CPI) in Mexico increased by 4.8% in April 2024 compared to the previous year, affecting affordability and expected returns. However, the cost of living in Mexico remains significantly lower than in the U.S. and Canada, enhancing overall affordability for expatriates.

Despite inflation, the real estate market in Mexico continues to offer attractive opportunities. The lower cost of living and more affordable property prices make it a viable option for foreign investors. Carefully analyzing market trends and understanding the impact of inflation helps investors make informed decisions and capitalize on higher rental rates and property appreciation.

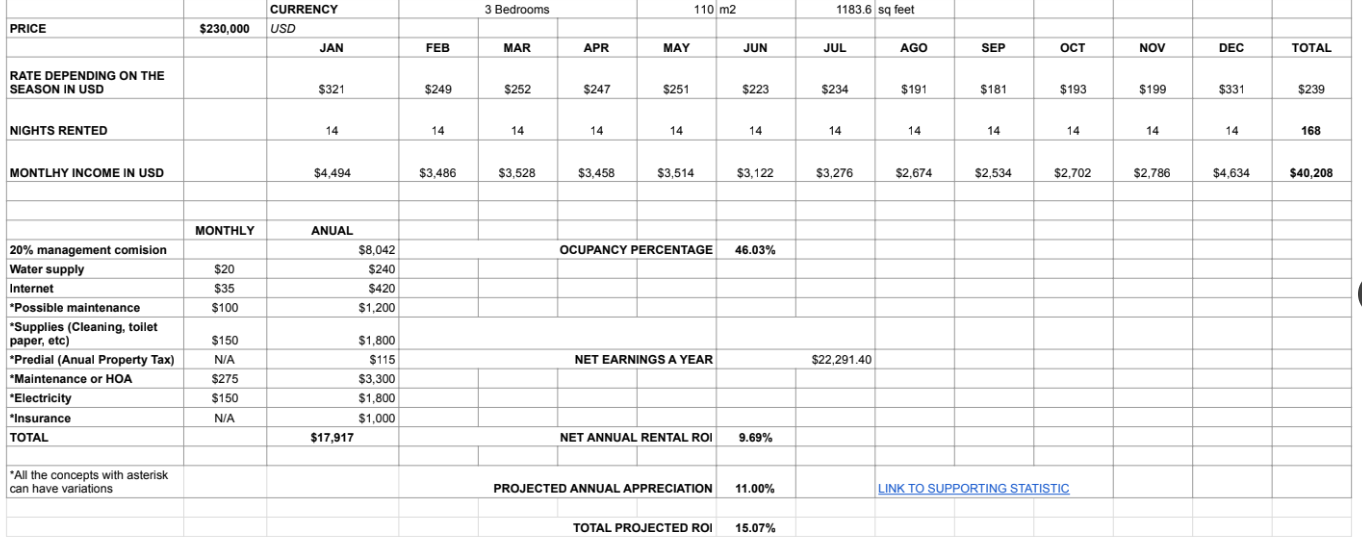

High Rental Yields and ROI

Mexico’s real estate market is known for its high rental yields and return on investment (ROI). With rental yields ranging from 6.3% to 9.0%, Mexico presents a lucrative opportunity for investors seeking profitable returns.

We will explore some specific rental opportunities and successful case studies to illustrate the potential.

Vacation rentals and Airbnb

Vacation rentals, particularly those listed on platforms like Airbnb, have become increasingly popular in Mexico due to the influx of tourists. Cities like Cancun and Tulum often see vacation rental yields exceeding 10%, making them highly attractive for investment. Tulum’s vacation rental market, for example, features over 5,000 listings with an average daily rate exceeding $250, showcasing high investment potential.

Airbnb rentals in Mexico can yield high returns, particularly in tourist hotspots like Playa del Carmen, driven by increasing travel demand. Seasonal travel trends drive the demand for vacation rentals, offering investors a lucrative opportunity to benefit from the booming tourism industry.

A 3-bedroom property in Tulum, with a 46% occupancy rate, can expect a combined ROI of approx 15%.

Long-term rental opportunities

Long-term rental properties in Mexico provide stable income and capital appreciation. Mexico City’s diverse neighborhoods cater to various investor interests, from luxury apartments to more affordable housing, providing a wide range of opportunities for long-term rentals.

Long-term rental opportunities offer investors a steady income stream and potential property value appreciation. This approach allows investors to capitalize on the growing demand for housing in urban areas, ensuring a reliable and profitable investment.

Case studies of successful investments

Mexico offers lucrative opportunities for high returns on investment through rental properties, especially in tourist-centric regions. For example, properties in Playa del Carmen can achieve rental yields of over 10%, appealing significantly to vacation rental investors.

In Puerto Vallarta, successful investors have reported a consistent 9% ROI on furnished vacation rentals due to high demand. Similarly, investing in long-term rentals within Mexico City can yield an average ROI of 8%, as urban demand continues to rise.

These success stories highlight the favorable economic environment for achieving high ROI in Mexico’s real estate market.

Affordable Property Prices and Cost of Living

Affordable property prices and a low cost of living make Mexico an attractive destination for real estate investment. In 2024, the estimated monthly living cost for an individual in Mexico is approximately USD $982, significantly lower than in many other countries.

Comparing costs reveals the financial benefits of investing in Mexican real estate.

Comparison with other countries

Living expenses in the United States are 148% higher for individuals compared to those in Mexico, and for a family, the cost of living in the U.S. is 139% more. In major cities, the cost of living and housing in Mexico can be up to 50% lower than comparable cities in the United States and Canada.

Average monthly utility costs for a single person in Mexico are around USD $42.20, making it significantly more affordable compared to other countries. Additionally, food, medical care, and insurance are notably less expensive in Mexico, further enhancing its appeal as a cost-effective investment destination.

Property tax advantages

Property taxes in Mexico are much lower than in the U.S. and Canada, making it financially appealing for homeowners. Homeowners in Mexico benefit from lower property tax rates, often ranging from 0.1% to 0.3% of assessed value.

Property ownership in Mexico comes with lower ongoing costs, especially due to affordable property taxes and maintenance fees. These financial advantages make Mexico an attractive option for real estate investment, providing significant savings over time.

Maintenance and management costs

Typical property maintenance costs in Mexico average around 1% of the property’s value annually, which is lower than in the U.S. or Canada. Monthly property management fees in Mexico can range from $75 to $100 for basic upkeep. HOA fees, for example, can be estimated by using the formula of 2.5 USD per square meter.

Typical management expenses for properties in Mexico are often lower than in North America, which helps reduce the overall cost of property ownership. These lower costs make it more financially feasible to invest in and maintain properties in Mexico, enhancing the overall affordability and attractiveness of the real estate market.

Legal Aspects of Buying Property in Mexico

Grasping the legal aspects of buying property in Mexico is essential for a successful investment. Foreigners can legally own Mexican real estate through mechanisms such as a fideicomiso, where a Mexican bank holds the title on behalf of the buyer.

Key legal considerations and steps are involved in purchasing property in Mexico.

Foreign ownership regulations

A fideicomiso is a 50-year bank trust that allows foreign buyers to hold the title while the bank acts as a fiduciary. This trust system enables foreigners to own property in restricted zones through a Mexican bank, providing a secure and legal way to invest in Mexican real estate.

The fideicomiso allows owners to use and manage the property as they would any other owned piece of real estate. A key advantage of the fideicomiso system is that beneficiaries can be specified in the trust, making inheritance smoother.

Understanding restricted zones

Foreigners wishing to purchase property in restricted zones typically need to utilize a fideicomiso. Foreigners wishing to purchase property in restricted zones must obtain a permit from the Ministry of Foreign Affairs, agreeing to be treated as Mexican nationals for the property. This process ensures compliance with local laws and offers a secure way for foreigners to invest in desirable coastal and border areas.

Grasping these regulations is essential for a smooth and successful investment experience.

Working with real estate agents

Partnering with reputable real estate agent is essential for navigating the complexities of the Mexican real estate market. Real estate agents in Mexico should ideally be members of the Associacion Mexicana de Profesionales Inmobiliarios (AMPI) to ensure professionalism and reliability. Seeking referrals from previous clients can also help in finding trustworthy agents who are knowledgeable about local market conditions and regulations.

Successful investments often involve leveraging local partnerships and focusing on high-demand areas. If you want a smooth buying process with knowledgeable agents that know the market, reach out to Mycasa Real Estate. By working with experienced professionals, investors can ensure compliance with legal requirements and make informed decisions.

Popular Locations for Real Estate Investment

Mexico offers a diverse range of real estate investment opportunities, from bustling urban centers to serene coastal towns.

We will explore some of the most popular locations for real estate investment in Mexico, each offering unique advantages and high potential returns.

Puerto Vallarta

Puerto Vallarta’s real estate market is booming, driven by its scenic beauty and vibrant tourism sector. The increasing influx of tourists to Puerto Vallarta contributes to enhanced demand for real estate investments, making it a prime location for both residential and rental markets.

Puerto Vallarta offers various opportunities for investors looking to capitalize on tourist-driven demand. Whether it’s luxurious beachfront properties or charming inland homes, the options are plentiful. This diverse market allows investors to find properties that suit their investment goals and yield substantial returns.

Playa del Carmen

Playa del Carmen has transformed from a fishing village to a trendy urban locale, attracting significant real estate investment due to its strategic location and amenities. The growth in tourism and development in Playa del Carmen has led to increasing property values and rental income opportunities.

This vibrant destination offers a range of investment opportunities, from sleek condos to sprawling villas. With its proximity to major US transportation hubs and a thriving tourism industry, Playa del Carmen continues to be a hotspot for real estate investment.

Mexico City

Mexico City’s real estate market is experiencing robust growth, driven by a diverse economy and strong demand for housing. The capital city’s property prices have shown resilience and a steady increase as urbanization continues.

Investors can find lucrative rental yields particularly in areas appealing to expatriates and young professionals. The cultural richness and infrastructure development make Mexico City an attractive place for new investments. Opportunities for commercial real estate investment have also surged due to the growing tourism and business sectors.

Currency fluctuations

Currency fluctuations play a significant role in real estate investment decisions.

The current exchange rate of the Mexican Peso to the US Dollar is $20.04.

The expected exchange rate for the Mexican Peso against the US Dollar over the next 7 days is $19.87, indicating slight fluctuations that could impact investment costs.

The predicted USD to MXN exchange rate by the end of 2024 is expected to reach $22.78.

Understanding these currency trends is crucial for making informed investment decisions and maximizing returns. By staying informed about currency fluctuations, investors can strategically time their investments to benefit from favorable exchange rates.

If you're close to pulling the trigger on your dream home but haven't yet found the exact property, work with an agent at Mycasa Real Estate to find that perfect property.

You may consider sending the purchase funds to be held in an attorney escrow account, until you're ready for purchase, and take advantage of the favorable exchange rate.

Steps to Successfully Invest in Mexican Real Estate

Investing in Mexican real estate requires careful planning and execution. From researching the market to securing financing and completing the purchase real estate, each step plays a vital role in ensuring a successful investment.

Here’s a step-by-step guide to help you navigate the process.

Researching the market

Conducting thorough market research helps identify prime locations and understand property value trends before investing. Knowing property prices, rental yields, and market trends is crucial for successful investments in Mexican real estate.

Analyzing local property values and trends is essential before making an investment decision. Thorough market analysis in Mexico includes evaluating property values, local amenities, and neighborhood trends.

By understanding the real estate market dynamics in Mexico, including property demand and pricing trends, investors can make informed decisions and maximize their returns.

Financing options

Foreign buyers in Mexico can explore various financing methods, including cross-border bank mortgages and developer financing. Developers often support financing through their own plans that cater to foreign investors, typically requiring a substantial down payment, usually around 30% to 50%.

An often overlooked financing option is personal lending. If you already own a property free & clear in your home country, acquiring a Home Equity Line of Credit (HELOC) is typically a quick turnaround of under 30 days and significantly less expensive than a traditional mortgage.

Another advantage is that once it’s paid off, it can be re-used, like any other credit line.

Completing the purchase

Buying real estate in Mexico involves navigating specific legal requirements that can differ significantly from other countries. Foreign ownership is regulated under the fideicomiso system, which allows foreign nationals to purchase property in restricted zones.

Working with experienced real estate agents can facilitate the buying process and ensure compliance with legal requirements. Foreign buyers have various financing options, including international mortgages and local bank loans, tailored for expatriates.

By following these steps and working with professionals, investors can successfully complete their real estate purchases in Mexico.

Summary

In summary, Mexico’s real estate market in 2024 offers a wealth of opportunities for savvy investors. Favorable exchange rates, economic stability, high rental yields, and affordable property prices make Mexico an attractive destination for real estate investment. By understanding the market, navigating legal requirements, and working with experienced professionals, investors can capitalize on Mexico’s thriving real estate landscape. Make the most of this exciting opportunity and consider investing in Mexican real estate today.

Frequently Asked Questions

Can foreigners legally own property in Mexico?

Yes, foreigners can legally own property in Mexico by using a fideicomiso, which allows a Mexican bank to hold the title on their behalf. This creates a secure ownership structure for non-Mexican buyers.

What are the property tax rates in Mexico?

Property tax rates in Mexico are generally lower than those in the U.S. and Canada, typically ranging from 0.1% to 0.3% of the assessed property value.

What are the benefits of investing in vacation rentals in Mexico?

Investing in vacation rentals in Mexico can offer high returns, especially in popular tourist destinations such as Cancun and Tulum. This lucrative opportunity capitalizes on the growing demand for short-term accommodations.

How does inflation impact real estate investments in Mexico?

Inflation can affect real estate investments in Mexico by impacting affordability and expected returns, yet the overall cost of living remains markedly lower than in the U.S. and Canada, which can still favor investment opportunities.

What financing options are available for foreign buyers in Mexico?

Foreign buyers in Mexico can access financing options such as cross-border bank mortgages, developer financing, and personal lending solutions like Home Equity Lines of Credit (HELOC). It's essential to assess these options carefully to determine the best fit for your needs.

Comments (0)