Mexico Real Estate Prices: Trends in Quintana Roo & Beyond

Real Estate Prices in Mexico: An Overview of Southern, Western, and Quintana Roo Housing Markets

Introduction

This article explores key housing price data for Mexico’s southern and western states, and delves into the latest trends from Quintana Roo, a state renowned for its booming real estate market, particularly in the Riviera Maya.

Mexico’s real estate market is dynamic and diverse, with housing prices varying significantly across regions. From the southern states to the western coastal areas, price trends are influenced by a combination of local economic conditions, demand for vacation homes, and investment opportunities.

If youre in the market and ready to take advantage of great opportunity for future growth, contact Mycasa Real Estate for expert advice from Licensed Agents.

Table of Contents

- The Quintana Roo House Price Index: Key Insights

- Southern Mexico Housing Prices

- Western Mexico Housing Prices

- Conclusion: Navigating Regional Price Trends

The Quintana Roo House Price Index: Key Insights

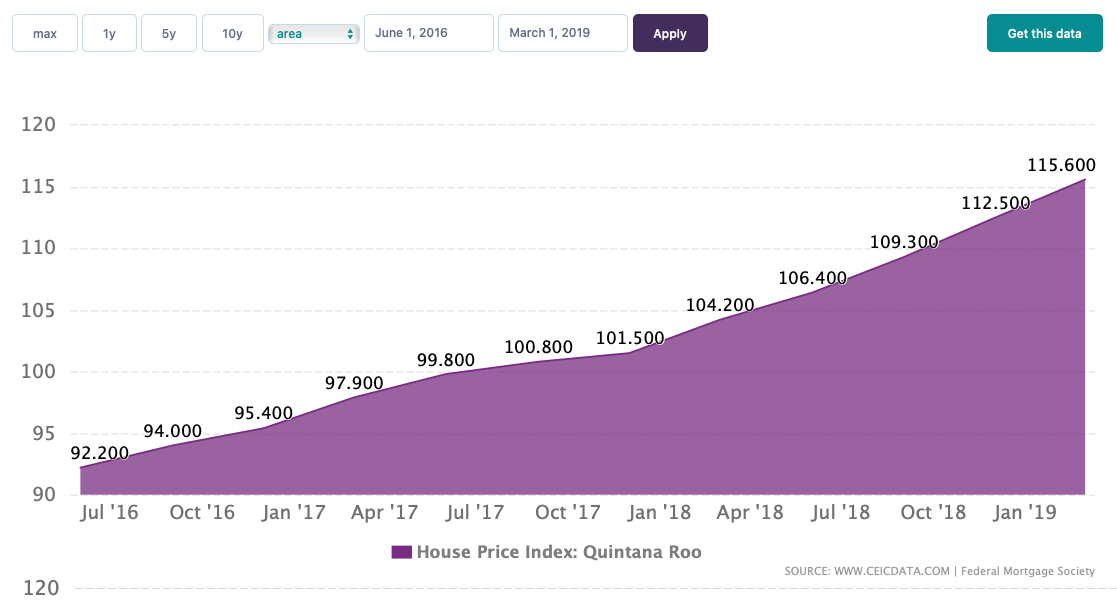

Quintana Roo, home to Playa del Carmen, Tulum, and Cancun, is one of Mexico’s most sought-after real estate markets, especially for foreign investors. According to the Quintana Roo House Price Index from CEIC Data, the average price of homes in the state has been consistently increasing, driven by both international demand for vacation homes and local investment.

In the first half of the year, Quintana Roo saw a notable price increase of 11.8%, highlighting the state’s strong growth potential. With property prices rising steadily in prime locations like Cancun and Tulum, Quintana Roo remains a hotspot for real estate investments.

For those interested in the numbers, the Quintana Roo House Price Index is a valuable resource for tracking price trends across the state, providing detailed insights into the movement of average home prices in different municipalities. The index data allows investors to assess market conditions and determine the best times to buy or sell based on regional trends.

To explore more detailed information on the Quintana Roo House Price Index, visit CEIC Data.

Southern Mexico Housing Prices

In southern Mexico, the real estate market presents a mix of affordable and moderately priced homes, with steady annual growth. Below are the average housing prices in the first half of the year for several southern states:

- Oaxaca: 1.618 million pesos (US $86,700), an annual increase of 11.5%.

- Michoacán: 1.578 million pesos (US $84,600), an annual increase of 6.4%.

- Guerrero: 1.518 million pesos (US $81,400), an annual increase of 7.3%.

- Chiapas: 1.339 million pesos (US $71,800), an annual increase of 11.5%.

These regions, known for their rich culture and growing tourism, offer affordable properties, making them attractive for both domestic buyers and international investors.

Western Mexico Housing Prices

Western Mexico’s housing market features some notable price variations, particularly along the Pacific coast. Here’s a look at the average housing prices for two states in the first half of the year:

- Nayarit: 1.757 million pesos (US $94,200), an annual increase of 11.7%.

- Colima: 1.349 million pesos (US $72,300), an annual increase of 10.6%.

Nayarit, in particular, is seeing significant growth due to its tourism appeal, especially in coastal areas like Puerto Vallarta. Colima, on the other hand, remains more affordable while still showing steady growth.

Conclusion: Navigating Regional Price Trends

Understanding regional price variations in Mexico is crucial for both buyers and investors. Southern states like Oaxaca and Chiapas offer affordable options, while western states like Nayarit are seeing substantial price increases.

Quintana Roo, with its thriving tourist industry, continues to offer attractive opportunities for investment, as evidenced by the ongoing growth reflected in the Quintana Roo House Price Index.

Whether you are looking for an affordable home in the south or a luxury property in Quintana Roo’s prime locations, understanding these regional trends will help guide your decision-making process in the ever-changing Mexican real estate market.

Comments (0)